From Portland, Oregon, to Portland, Maine. From Jacksonville to Juneau. No matter where you look, there isn’t enough affordable housing.

Without exception, there is no county in the U.S. that has enough affordable housing. The crisis is national and it is growing. Since 2000, rents across the nation have increased. So has the number of of families who desperately need affordable housing.

New research from the Urban Institute shows that the supply of housing for extremely low-income families, which was already in short supply, is only declining. In 2013, just 28 of every 100 extremely low-income families could afford their rental homes. Than figure is down from 37 of 100 in 2000—a 25 percent decline over a little more than a decade.

CityLab reports:

Using data from the Census Bureau and the U.S. Department of Housing and Urban Development, researchers built an interactive map to illustrate the nationwide reach of the problem. In no county in the U.S. does the supply of affordable housing meet the demand among extremely low-income households. (Families who made no more than 30 percent of an area’s median household income were considered “extremely low income.”)

A closer look at affordable-housing access for the extremely poor in Travis County. (Urban Institute)

Read full coverage here.

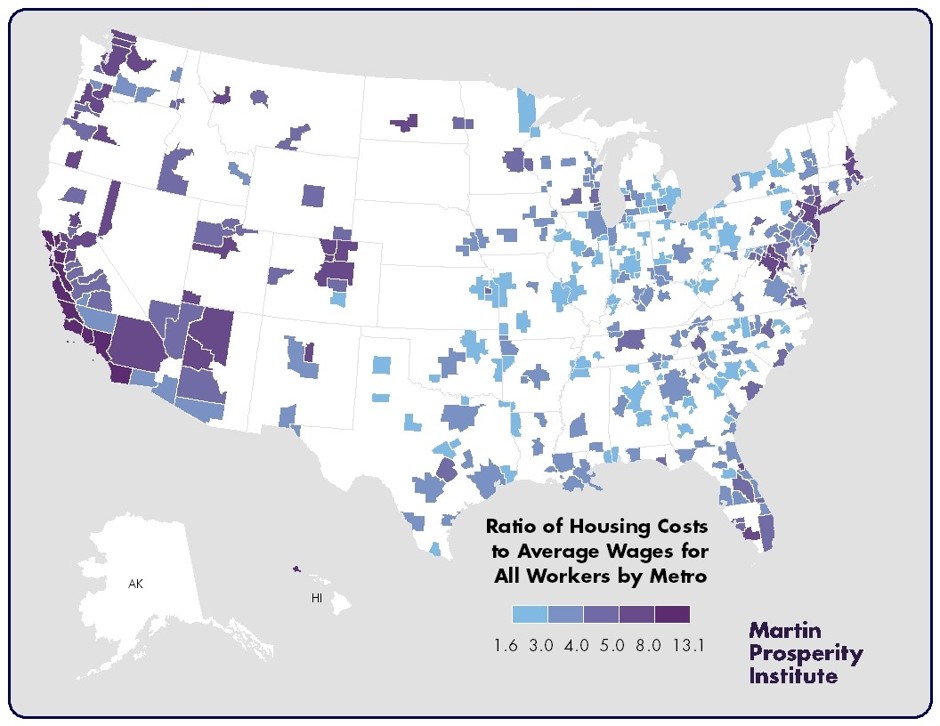

Where Housing Costs The Most

In many communities across the country, service workers must save up for several years or decades to purchase a home. In San Jose, for example, one service worker can expect to set money aside for 20 years before being able to buy a house.

CityLab’s Tanvi Misra reported the average U.S. citizen needs to earn $19.39 per hour to afford the average two-bedroom apartment. That salary is more than 2.5 times the minimum wage.

According to CityLab‘s research:

The price of a home should roughly be 2.6 times one’s take-home pay.

The metros where households need to devote more years of wages to purchase a home are in purple, while those where people need to devote fewer are in light blue.

The first map, below, charts how many years of wages it takes to pay for a home for the average American worker. Look at the dark purple on both coasts: Workers are devoting 10 or more times their take-home pay to buy a home in these areas.

In Santa Cruz, it would take the average worker 13.1 years’ worth of wages to buy a home. In Honolulu, it’s 12.8 years of wages, San Jose 11.5 years, and San Francisco 11.0 years. Other metros where housing is far out of reach for the average worker include New York (6.6), greater Boston (6.2), and Washington, D.C. (5.6), on the East Coast. There are also some expensive surprises:Bismarck, North Dakota (6.0); Fort Collins, Colorado (5.9); and Missoula, Montana (5.9).

There are very few places where workers can buy a home for less than the 2.6-years’-worth-of-income rule of thumb—mainly metros in the Rustbelt. Across the nation, it takes nearly four years’ (3.9) worth of wages for the average worker to buy a metro home.

Read full coverage here.